“Pabbly Subscription Billing is the only recurring payment service that offers an integrated affiliate module.” Pabbly Subscription Billing – Subscription Management Software

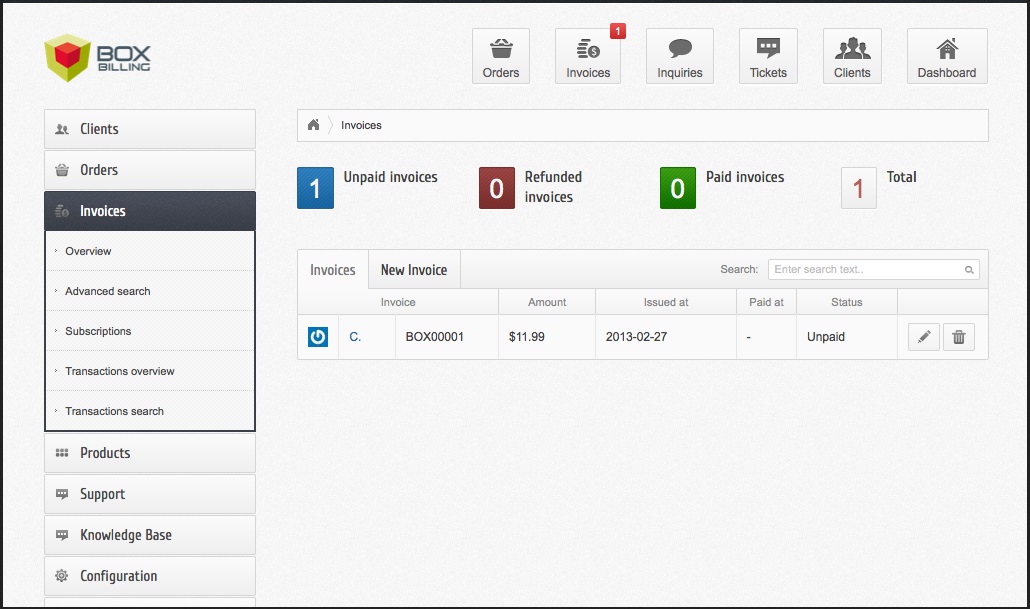

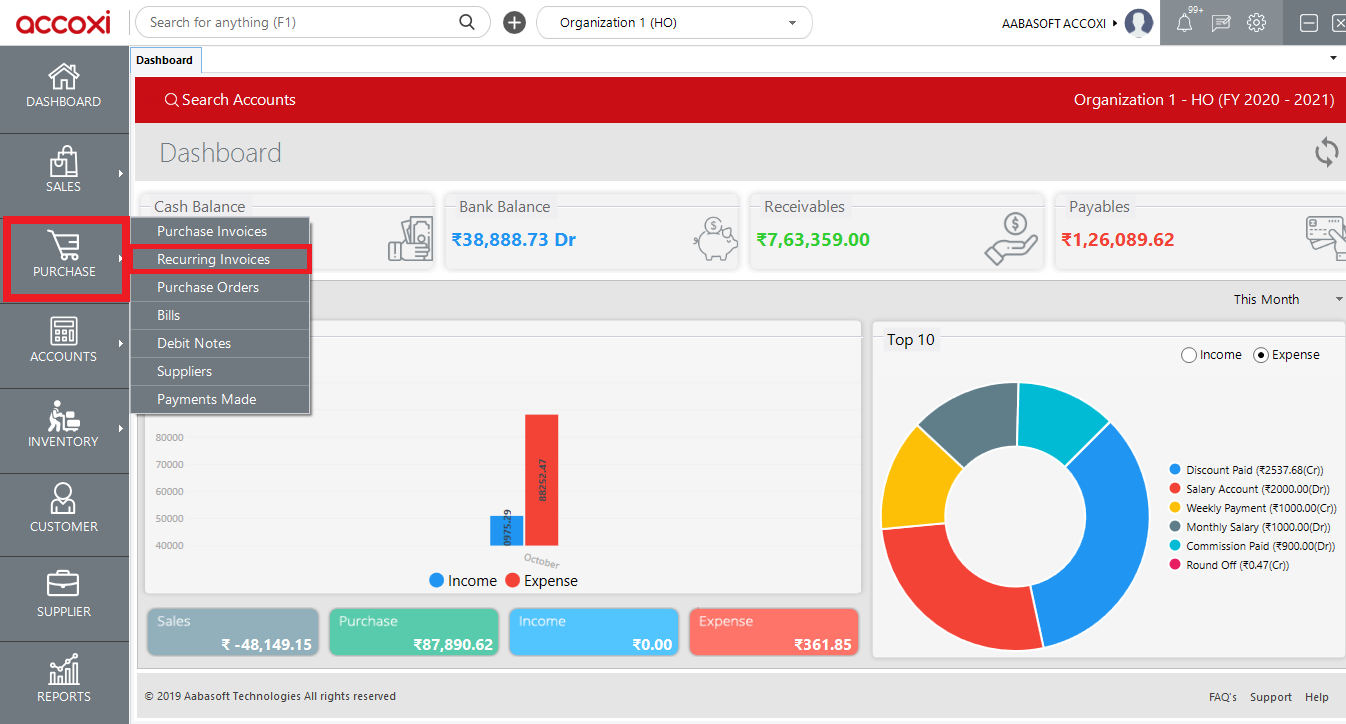

You will then be able to print the Tax Invoice and send it to the customer.So, let’s get into the details without wasting any more time.ġ. Process Tax Invoices, which will process the selected Draft Invoices as the Tax Invoices, but will not send them.Process and Email, which will process the selected Draft Invoices as Tax Invoices and email them to the relevant Customers.The next time the system processes the Recurring Invoice, the Draft Invoice will be generated as per the original setup information. If you delete the Draft Invoice at this stage, it will only delete this invoice occurrence and not delete the original Recurring Invoice.

You can also delete the Draft Invoice by clicking on the delete link next to the Draft Invoice line.

#RECURRING INVOICE SOFTWARE FREE UPDATE#

The changes that you make to the Draft Invoice will only apply to this invoice occurrence and will not update the original Recurring Invoice. You can edit a Draft Invoice by clicking on the edit link next to the Draft Invoice line. The system selects all of the invoices by default. You can select all by clicking on the Select All button or deselect all by clicking on the Deselect All button. You can now select the Draft Invoices that you want to process. Click on Save or Save and New to update the system with this information and/or create a new Recurring Invoice.Add a message in the Message box, if applicable.Enter the invoice information in the lines by selecting the Items or Accounts that need to be invoiced.Check the Use Inclusive Amounts check box to enter inclusive prices, and uncheck the check box to enter exclusive prices in the Lines section.You then enter or select one of the multiple delivery addresses.Select whether you want the system to save the Recurring Invoice as a draft or to process and send the new Invoice to the customer automatically.The software automatically populates your registered company email address in this field.

Check the CC check box if you want to send a copy of the invoice to yourself or another recipient.Click Email Signature to enter text that will be included in the body of the sent email. Email address, if the Invoices are to be sent automatically.Due Date for Payment, which the system uses to calculate the Payment Due Date on each Invoice created from this Recurring Invoice.End Date, which will indicate when the system must stop creating Invoices from this Recurring Invoice.Frequency of the Recurring Invoice, be it daily, weekly, monthly, annually, and so on.The Recurring Invoice is reliant on the information specified in this section. Specify the Recurring Invoice details in the Recurring Invoice Setup section.If it is not, the system will not create any new Invoices from this Recurring Invoice. Ensure that the Active check box is checked.If a discount applies to the customer transaction, enter a discount percentage in the Discount % field.Enter a transaction number, name or description in the Reference field for future reference purposes.The next consecutive number will be allocated by the system when the Recurring Invoice is saved. If there are multiple users set up on your company, the Recurring Invoice Number field will display NUMBER. The system will generate the next Recurring Invoice Number.Select the Recurring Invoice recipient from the customer drop down list.Complete the screen with the following information:

0 kommentar(er)

0 kommentar(er)